Q&A: Asset Segregation for Cleared OTC Derivatives

A Q&A to address questions on asset segregation models to support cleared OTC derivatives from webinar attendees

Latest Posts

ISDA, EBF, ICMA and ISLA Publish Whitepaper on the Benefits of Post-trade Risk Reduction Services

The International Swaps and Derivatives Association, Inc. (ISDA), the European Banking Federation (EBF), International…

ESMA Continues to Focus on Convergence in Enforcement of IFRS Across the EU

The European Securities and Markets Authority (ESMA) has published its 2017 annual report on…

CLS and NEX expand FX forward compression service to third parties

triReduce CLS FX service compressed USD6 trillion notional to date and signed six additional…

Elixirr and Kaizen Partner to Bring New Level of Transaction Reporting Compliance

Consultancy Elixirr, and Kaizen, the regulatory reporting assurance experts, have announced a new partnership,…

Shield FC launches new version of eComms Data Management Platform and Compliance Reporting Suite

Robust data management and record-keeping platform automates all eComms data acquisition & correlation, and…

ESMA Agrees to Prohibit Binary Options and Restrict CFDs to Protect Retail Investors

The European Securities and Markets Authority (ESMA) has agreed on measures on the provision…

IHS Markit SFTR Solution Adds Five Industry Design Partners

Business information provider IHS Markit today announced that the repo, securities lending and borrowing,…

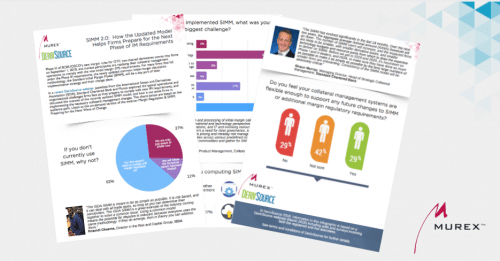

SIMM 2.0 How the Updated Model Helps Firms Prepare for the Next Phase of IM Requirements (Infographic)

In a recent DerivSource webinar, panellists from the International Swaps and Derivatives Association (ISDA),…

Intercontinental Exchange Announces Transition of Credit Default Swap Open Interest from CME Group to ICE Clear Credit; Launches CDX Clearing at ICE Clear Europe

Intercontinental Exchange (NYSE: ICE), a leading operator of global exchanges and clearing houses and…

SIMM 2.0 Implementation: Lessons Learned from a Phase One Dealer

The third phase of BCBS-IOSCO’s margin requirements for cleared and non-cleared derivatives will go…