By George Bollenbacher

There’s a small storm brewing in a corner of the swaps market which may or may not become a big deal. Whatever happens, everyone needs to become familiar with the possibilities, and plan for the possible changes, which are happening very soon.

What It’s All About

The issue relates to cleared OTC derivatives, which the BIS currently shows as $347 trillion in global outstanding volume. For that group of swaps the clearinghouse, or central counterparty (CCP), collects and holds margin, both initial and variation – initial from both sides and variation from one side. Since the holder of that margin collateral receives any interest paid during the holding period, even though it isn’t the actual owner, the collateral holder has to pay to the collateral provider something called price alignment interest, or PAI, as compensation. PAI is often referred to as “the overnight cost of funding collateral.” In addition, certain market values are discounted by the CCP at the same interest rate.

For the CME and LCH, as well as for most lesser CCPs, that interest rate has been either at the Effective Fed Funds Rate (EFFR) or EONIA, but that is about to change. Going forward, $-denominated PAIs and discounts will be calculated on SOFR and €-denominated will be calculated on €STER. However, like every other reference rate change, it’s not that simple. The question is – how do we get from one shore to the other without falling into the river?

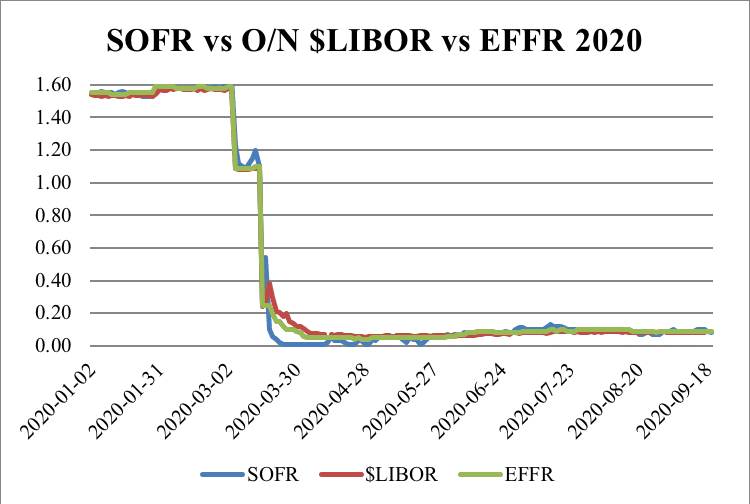

One question before we go further: How big a deal is the discontinuity between SOFR, overnight $Libor and EFFR? I looked at these three rates on a daily basis for YTD 2020, and here’s what they look like:

We can see that there was some discontinuity during the very volatile pandemic period in March, but otherwise they are within an average of 3 BP of each other the rest of the year, which might raise questions as to why we’re undertaking this exercise at all. But we are, so next we need to determine…

What It Means

By now we know that there are two fundamental changes when going from one of the old reference rates to the new ones: 1) the tenor conversion and 2) the credit risk component. Because all the PAI and discounting has been based on an overnight rate already, issue number 1 doesn’t apply here, but issue number 2 does. Both EFFR and EONIA, as well as all the other IBORs, are based on interbank unsecured lending, which means that they incorporate the credit risk assigned to banks in general by the market. While €STER is also an interbank unsecured rate, SOFR is a repo rate using Treasury collateral, meaning that there is virtually no perceived credit risk involved in it.

Thus we have a rather tricky transition from EFFR to SOFR in this usage. Simply jumping from EFFR to SOFR will result in a somewhat lower PAI and discounting rate, and thus an economic benefit to the paying party. One correction possibility is to add a credit spread to SOFR to make it equivalent to EFFR, but that only works at the point of transition. Thereafter, if the perceived credit quality of US banks in general changes, the SOFR-plus-spread will no longer equate to what the EFFR would be. One could set up the spread to track the EFFR over time, but that assumes a reliable EFFR, and if we had that we wouldn’t need to go through this whole exercise in the first place.

Adding the Complications

In September the International Swaps and Derivatives Association (ISDA), along with Linklaters, hosted a webinar on the subject of Collateral Changes for US Dollar and Euro Derivatives. Contained in the accompanying presentation were some insights into how this transition might go, as well as some of its implications. To begin with, this webinar only addressed two CCPs: the CME and the LCH, who have the lion’s share of clearing for US and EU derivatives.

The webinar began by pointing out that both CCPs had set transition dates for moving from the old rates to the new. For EONIA to €STER the transition date is (was) July 24, 2020, and for EFFR to SOFR it is October 16, 2020. For the EU transition, the webinar said that, for “Value compensation: Cash compensation was paid between the CCP and each clearing member (CM) to compensate for the change in value of each euro-denominated position (house and client) on the transition date as a result of the switch from EONIA to €STR discounting, [and for] Risk compensation: Not applicable (EONIA is currently a tracker of €STR).”

However, the transition from EFFR to SOFR is more complicated. For that the webinar said, “Value compensation: Cash compensation will be payable between the CCP and each CM to compensate for the change in value of each US dollar-denominated position (house and client) on the transition date as a result of the switch from Fed funds to SOFR discounting…Risk compensation: Fed funds vs SOFR basis swaps will be allocated to all accounts at the CCP (other than, in the case of LCH, client accounts who have opted out of receiving such swaps)…Auction process: CMs may dispose of/bid for discounting risk swaps which are not wanted by clients in an auction held by the CCP.”

Perhaps more importantly, the two CCPs have different approaches for EFFR-to-SOFR, although both plan to use October 16thas the transition date. Specifically:

The transition process itself:

- “At COB on October 16, CME will value all US dollar-denominated trades using fed funds discounting. CME will then generate a discounting transition report that provides the net present value (NPV) of all trades using SOFR discounting.”

- “LCH will hold a mid-setting auction on October 16, 2020 to provide a reference for constructing the SOFR curve. At COB on October 16, LCH will value all US dollar-denominated trades using fed funds discounting and SOFR discounting.”

For cash compensation:

- At the CME, “The discounting transition report will include details of cash adjustment amounts payable between CMs and the CCP in respect of all contracts (house and client) to account for the valuation change as a result of switching from fed funds to SOFR.”

- At the LCH, “The mid price generated via the mid-setting auction will be used to determine cash compensation payable between CMs and the CCP in respect of all contracts (house and client) to account for the valuation change as a result of switching from fed funds to SOFR.”

For re-establishing hedge positions:

- “CME will book a mandatory series of NPV neutral fed funds/SOFR basis swaps to all CMs’ house and client accounts.”

- “LCH will book a series of NPV neutral fed funds/SOFR basis swaps to all CMs’ house and client accounts. Clients can opt-out of receiving swaps and instead receive cash compensation.”

But perhaps the biggest difference is in the area of auctions:

- “On October 19, 2020, CME will hold an auction which CMs can use to dispose of unwanted fed funds/SOFR basis swaps allocated to client accounts.”

- At the LCH “Two auctions will be held on October 16, 2020:

- A mid-setting auction to generate the mid price for constructing the SOFR curve and determining cash compensation payable.

- A second auction for disposal of unwanted fed funds/SOFR basis swaps and determining the alternative cash compensation payable to or by opted-out clients.”

Finally, the deadlines for opting into or out of the auctions:

- For the CME “October 2, 2020 (with CM approval of opt-ins due by October 9, 2020)”

- For theLCH “for opting out of receiving compensating swaps: September 4, 2020”

Because this is such a complicated transition, in July the CFTC published a Discounting Transition Tabletop Exercise, which lists and discusses the following seven scenarios:

- Processes at Both CCPs go According to Plan

- Failed Auction for Discounting Risk Swaps

- Operational Failure

- Member Default

- FCM Not Operationally Prepared for CCP Discounting Transition

- Prefunding Needs / Risk Limits

- COVID-19 Related Interruptions

In addition, the CFTC highlights the main differences between the two CCPs’ approaches:

| CME | LCH | |

| Option to Not Receive Discounting Risk Swaps | No | Yes |

| Timing of Auction | Monday, 10/19/2020 | Friday, 10/16/2020 |

| Cash Compensation SOFR Valuation Methodology (EOD on Friday, October 16th) | Calculated using EOD SOFR curve | Calculated using levels from mid-setting auction |

One other important piece of reading is ISDA’s Collateral Agreement Interest Rate Definitions, which document covers much more than just the definitions of the rates. For example, it has a section on “Parties responsible for determining the appropriateness of the Collateral Agreement Interest Rate Definitions,” and covers such additional definitions as: Index Cessation Event, Negative Interest Protocol, and Interest Rate Override. Each rate section also covers not only the rate itself, but such things as fallbacks.

Finally, the ISDA webinar highlighted key issues for the transition from EFFR to SOFR:

- For CMs

- “Members need to familiarise themselves with (and inform their clients of) the differing processes at each CCP and, in particular, the different deadlines for client elections in respect of discounting risk swaps.

- Certain CMs will be required to participate in the discounting risk swap disposal auction (either as a result of the election of their clients or due to the size of their own US dollar cleared portfolios). “

- For CM Clients

- “Clients that opt out of receiving discounting risk swaps may nevertheless be allocated such swaps if the auction is not successful. Clients will need to discuss strategies with their CMs, and ensure operational readiness, for disposal of these swaps in the market, noting the potential impact of a failed auction on liquidity in the SOFR market.”

- For Other Market Participants

- “An auction in which some or all of the allotted discounting risk swaps are not liquidated could be potentially disruptive to the pricing and liquidity of SOFR instruments, leading to a negative outcome for the market overall.”

The ISDA/Linklaters webinar covered quite a bit more on this subject, so anyone who is involved in cleared derivatives should get in touch with either of the sponsors to get a complete rundown on this potential thunderstorm. After all, you don’t want to get caught in a downpour without your umbrella.