This Q&A with Malavika Solanki, Management Team, Derivatives Service Bureau, provides an introduction to the Unique Product Identifier (UPI), a new product level identifierused by the OTC Derivatives industry. We examine how the different standards and codes work together in concert with the UPI, and the implications for the OTC derivatives industry.

The FSB announced on 2nd May 2019 its decision to designate the Derivatives Service Bureau (DSB) as the sole service provider for the future Unique Product Identifier (UPI) as well as the UPI Reference Data Library, describing it as a key step in completing the governance framework for the UPI System.

Alongside the provision of International Securities Identification Number (ISIN), Classification of Financial Instruments (CFI), and Financial Instrument Short Name (FISN) codes for over-the-counter (OTC) derivatives, the DSB will be providing UPIs in the near future to enable authorities to aggregate OTC derivatives data reported to trade repositories to help assess systemic risk and detect market abuse. Information about the DSB’s OTC derivative CFI generation process can be found further down this Q&A.

Q: What is a UPI?

Malavika: The UPI is designed to facilitate effective aggregation of over-the-counter (OTC) derivatives transaction reports on a global basis. The role of the UPI in particular is to uniquely identify the product involved in an OTC derivatives transaction that an authority requires, or may require in the future, to be reported to a Trade Repository (TR). The UPI will work in conjunction with the reporting of Unique Transaction Identifiers (UTIs) and Critical Data Elements (CDE) which will provide regulators with an improved, consistent view and common understanding of systemic OTC derivative risks.

While this is the main objective of the UPI, the UPI technical guidance acknowledges that this new identifier should be capable of meeting diverse regulatory needs, by supporting regulatory functions including market surveillance, risk analysis, public dissemination of market information, and regulatory research. For this reason, the technical guidance envisages that the UPI should be “comprehensive” enough to be utilised to create other, more granular derivatives identifiers for other purposes, provided that this does not hinder the primary use of the UPI as defined for the reporting of OTC derivative transactions to a TR or for regulatory use.

Q: When will the UPI become available?

It is expected that the UPI will be available for regulatory reporting in Q3 2022, with regulatory reporting aligned with the needs of individual jurisdictions. The DSB continues to liaise with stakeholders, including the Regulatory Oversight Committee, the DSB’s industry forums (Product Committee and Technology Advisory Committee), as well as market participants and will make further information available as soon as practicable.

Q: Where does the UPI sit amongst other relevant identifiers?

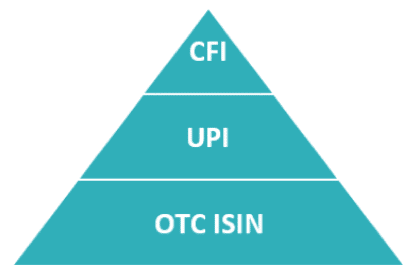

Malavika: International Securities Identification Numbers (ISINs) and the Classification of Financial Instruments (CFI) code are globally recognised and adopted ISO standards. From a market practitioner perspective, each of the CFI code, UPI, and ISIN serves a specific purpose and can be considered complementary in nature to each other. Together with the UPI, they will provide an identification framework for OTC derivatives. The UPI will sit between the CFI and OTC ISIN as a product level identifier, reflecting a subset of the data elements required for OTC ISIN.

Q: How does the DSB generate CFI codes?

Malavika: The DSB currently auto-generates CFI codes as part of the OTC ISIN generation process, using a subset of the attributes contained within the relevant OTC ISIN product definition. CFI codes are generated in accordance with the requirements of the ISO 10962 standard, under the governance of the DSB’s Product Committee.

Q: What are the primary characteristics of the CFI?

Malavika: A helpful way to look at the CFI code (ISO 10962) is to think of it as a means of determining what something is, in a way that describes some of its primary characteristics. Looking at a real world example, the CFI code would tell you the asset class, instrument type, underlying asset type, notional schedule, whether the instrument was single or multi-currency, and last but not least, the delivery type. So, the CFI code would let you determine that the instrument was a single currency, fix-float, interest rate swap with a constant notional schedule and cash delivery.

Q: How does the CFI code compare with the UPI?

Malavika: The UPI (ISO 4914– under development) would then tell you a little more detail about the product. So, if the CFI says it is a single currency, fix-float, interest rate swap with a constant notional schedule and cash delivery, the UPI would inform you that the product also had the following attributes: a three month reference rate term, a USD reference rate, and that the name of the reference rate was USD-LIBOR-BBAR.

Q: And, how does that relate to the OTC ISIN?

Malavika: The OTC ISIN (ISO 6166) would tell you yet more about the granular details of the instrument that had been transacted. Building on the example described above, the CFI and UPI together tell us that the product is a cash delivered, single currency, fix-float, interest rate swap with a constant notional schedule, a three month reference rate term, a USD reference rate, and that the name of the reference rate was USD-LIBOR-BBAR. The OTC ISIN would expand on this information by including information such as the standardized ISO reference rate name, the price multiplier associated with the instrument, the full name and short names of the instrument, the expiry date of the specific instrument that was transacted.

Q: How do they work together?

Malavika: If we look at how the three combine, the OTC ISIN is contingent on alignment with a range of allowable CFI values, and the OTC ISIN hierarchy allows sufficient flexibility to cater for EU data elements and enumerations that are EMIR required. From a market perspective, the OTC ISIN might be expected to contain the CFI and the UPI as part of the metadata in the instrument record, therefore delivering synergies to users who may need all three for differing purposes.

Because the OTC ISIN is the most granular of the three, based on what we know today, the range of data elements and the allowable values for each data element used to define the OTC ISINs are expected to be premised on the values of each of the CFI, UPI and additional values required by EMIR, MiFID II & MIFIR regulations as well as further granularity as required by the market.

Based on the content of the technical guidance published by CPMI-IOSCO in September 2017, the UPI is de facto based on a subset of the data elements required for OTC ISIN. So the OTC ISIN effectively is comprised of the things you use to define a CFI, UPI, and the things required to be reported for regulatory reporting and also any additional data elements that market practitioners may require. While UPI was not conceived to be complementary to OTC ISIN/CFI, it is however a fact that the data elements that are contained in both OTC ISIN and UPI are aligned. Complementarity is desirable to deliver synergies to users who may need all three IDs for differing purposes and to allow UPI to be meet the “comprehensiveness” key characteristic as defined in the UPI Technical Guidance document.

Take the case, for example, of a credit default swap (CDS), the index series and the index version. Those data elements are not mandated as reportable under MiFIR or MiFID, but the OTC ISIN granularity contains them because the market deemed it appropriate. So, the OTC ISIN can be as granular as the market and regulators need it to be.

Q: Do we always need all three?

Malavika: The CFI, UPI and OTC ISIN each refers to a different purpose. Based on published information, the UPI is less granular than the OTC ISIN, but is premised on a subset of data elements, and the purpose of the UPI is to assist with broader global regulatory risk aggregation related reporting, in particular trade reporting to data repositories around the world. There is today, an ongoing discussion in industry as to how each of the CFI and UPI may be used, but in essence, each offers a different level of granularity, and each seeks to serve a differing purpose.

Not every derivative has all three. Some may have none at all – if they are only traded in areas that do not mandate such identifiers as part of their reporting requirements. Other OTC derivatives are subject to global reporting to trade repositories but are not required to have an ISIN under MiFIR/MiFID II, and they are the OTC derivatives that are expected to need a UPI. There is then a third group of derivatives that are subject to MiFIR/MiFID II, and Market Abuse Regulations which need an ISIN. So in essence, each identifier has a specific granularity to reflect the intended purpose, and the DSB’s data model is able to accommodate each within the prevailing architecture.

Q: How does industry feed into the DSB’s product definition process?

Malavika: Industry participants are represented at the DSB’s Product Committee which is comprised of a broad based set of market practitioners, trade association representatives, and regulators. Together they are responsible for overseeing the product definition and data alignment related aspects of the CFI codes, FISNs, UPIs and OTC ISINs issued by the DSB. For further information please contact otc.data@anna-dsb.com.

—