As the industry readies itself for the looming deadline for the acceleration of the settlement cycle to T+1, many firms, both buy and sell side will be contending with various operational challenges.

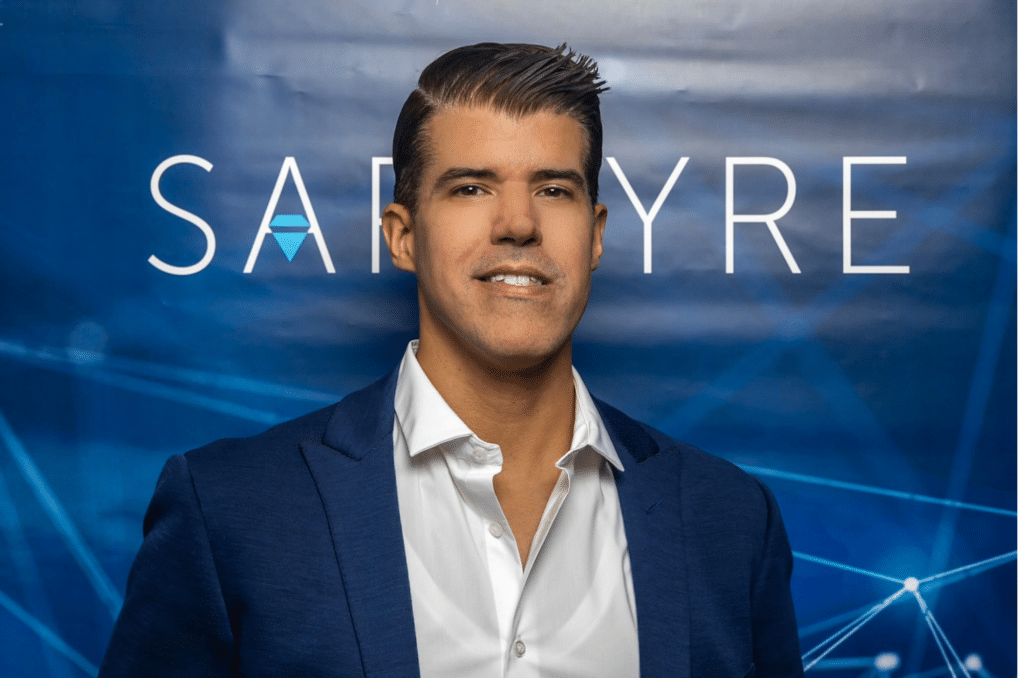

In this episode of the DerivSource Podcast, Living the Trade Lifecycle, Gabino Roche, the CEO and founder of Saphyre, shares his views on two of the top challenges – SSIs and potential after hours liquidity hiccups – that firms must address now to ensure they can settle trades efficiently and within the constraints the T+1 settlement cycle introduces.

In this episode, we explore:

- Are firms ready for T+1 now?

- Are firms investing in technology and automation to prepare or relying on short-term solutions such as increasing staffing resources?

- What are the common hurdles firms face in adjusting SSI related processes ahead of T+1?

- What is the “witching hour” and how can this create potential challenges in managing liquidity?

- What do you think is the golden opportunity that T+1 is introducing for the industry?

- What should firms be focusing on now to ensure they are ready and able to settle trades on T+1 efficiently come the deadline?

About Gabino Roche, JR CEO & Founder, Saphyre

Gabino has over 20 years of experience in building technology solutions for Fortune 500 companies and start-ups from the 1990s Dot-com era till now.

He’s a former McKinsey & Company firm member where he learned and was focused on delivering products faster to market. That enabled him to take on a role at NYSE as Managing Director of application development to help their startup division ramp towards a $1 billion revenue goal.

Later he worked as a senior vice president at JP Morgan executing transformation programs in business operations, overseeing technology and operational process initiatives such as a delivering a $40m product in their custody portfolio, and helping to revamp the Corporate Investment Bank’s (CIB) KYC/AML operations.

That experience set him up for JPMorgan’s senior management to ask him to take on the Head of Product role at Clarient; a FinTech startup consortium put together by JP Morgan, Goldman Sachs, State Street, Credit Suisse, Barclay’s and DTCC. While there he oversaw an $80m budget and with his team assisted to transform the company’s operations, technology, and product in under six months to meet market deadlines.

It was here where he unearthed valuable insights on how to structure pre-trade data and documents, invent an intuitive and expedited onboarding process powered by patented AI, in order to resolve many of the trading and post-trade issues – leading to his creation of his own FinTech startup; Saphyre.

Related reading and resources: