With the zero-interest rate era many hikes behind us, a phase of monetary policy divergence means traders face a more complex economic backdrop for managing risk. Content contributed by ICE’s Interest Rates Team.

Central banking is challenging at the best of times. Seen in the narrowest sense, the ability of a group of economists to reconcile a complex economic system through inflation targeting has raised many questions. This dynamic does not consider the uniqueness of recent times. Inflation across the OECD has proven difficult, ever since the post pandemic unlocking collided with inflation shocks, where supply chain bottlenecks and geopolitical tensions were exposed.

At present the UK looks to be more exposed to idiosyncratic shocks than its contemporaries, where some drivers are internal and relate to fiscal experimentation. More importantly, external factors related to key commodities and the international orientation of the UK economy remind us that economic resilience to outside shock is not equal. Asynchronous economic performance and consequent monetary policy responses are now resulting in a period of divergence, posing a dilemma for those managing interest rate risk.

In truth, economic divergence tends to come in waves. The recent wave has centred around monetary policy actions from the Federal Reserve. Tomorrow’s waves may relate to cross currents of actions from the European Central Bank, Bank of England, Bank of Japan, and Swiss National Bank. ICE has positioned its interest rates business as a multi-currency offering through Euribor, SARON, SOFR and SONIA, noting that the post zero interest rate policy years would likely see the return of monetary policy divergence.

In the UK, the weaker than expected inflation data for August has spurred the return of multicurrency precision where SONIA volumes are setting new record highs. On September 20, SONIA Options had a record day with 753K lots traded. SONIA Futures & Options had the best combined volume day ever with 1.58 million lots traded. SONIA Futures & Options open interest (OI) continues to grow – up 28% from the aftermath of the U.K. mini budget, marking the return of confidence by investors to U.K. interest rate markets.

Back in July, market expectations were for UK rates to reach 6.5% by Q2 2024. Following the weaker August CPI and Retails Sales data, 125 bps of higher rate expectations have now been repriced; rates cuts are starting to be priced in for late 2024. SONIA remains an attractive contract for those seeking a precise way to express a view on monetary policy.

Citi’s Head of Sales & Execution, Futures Derivatives & Clearing, Chris Stone notes, “Client interest has increased markedly with the rise in volatility around terminal rate expectation and SONIA gives the exposure to this variance”.

An uplift in SONIA trading volumes

The Bank of England’s decision on September 21 to hold interest rates at 5.25% – the highest level in over 15 years – was finely balanced between rates being unchanged versus another hike.

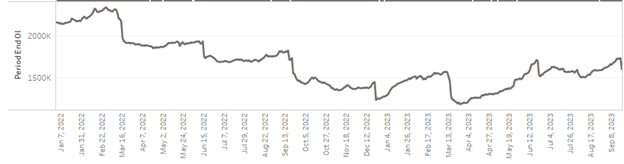

The graph below shows ICE has recorded more open interest across SONIA futures post the June 2023 futures contract expiry than essentially the last three prior quarters, illustrating the strength of the complex and market interest in managing sterling rate risk exposure.

Average daily volume in ICE’s SONIA complex (futures and options) is up 19 percent year to date vs 2022, highlighting growing participation from a wider range of market participants.

Are central banks now looking at a “new norm” levelling rate? Will more rate cuts start earlier for 2024?

As we enter the next wave, ICE sees a liquid multi-currency offering can best serve the needs of its customers.