Waves of regulation in recent years have fundamentally changed the derivatives landscape and driven increased automation. In a Q&A, Stephen Bruel, head of Derivatives and FX, Market Structure & Technology at Coalition Greenwich, discusses the key findings of a recent report called “Derivative Market Structure 2023: Optimization is not at the Margins”. Read on for insight into the macro trends impacting derivatives market structure – regulation, margin and capital management – are behind efforts to maximize the economic value of derivatives trading desks.

Q: What were you looking to find out with this study?

A: The goal of the study was to assess where the industry is today and what its key priorities are. We interviewed 60 derivatives professionals globally between January and February 2023, and we asked questions ranging from current priorities to areas of investment spend, to discussions about where the industry might be headed.

Q: What were your top findings?

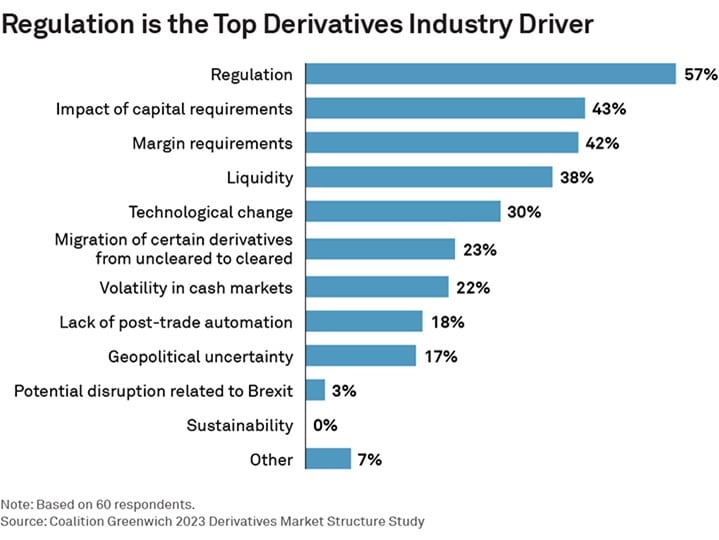

A: The most important issues facing the market today are regulation, capital requirements and margin requirements. (The chart below shows the main drivers impacting the derivatives industry in 2023.) These three things are very closely connected. Twelve years on from the Great Financial Crisis (GFC) and Dodd-Frank and EMIR, the impacts of those regulations are still being felt. However, margin and capital are not just important because of regulation—good margin and collateral management are effective way to maximize the economic value of the derivatives trading desk.

Regulations such as Basel I, Basel II, and the Global Systemically Important Banks (GSIB) designations specified the amount of capital and collateral large firms must hold. Uncleared margin reform forced firms to rethink their margin operations and documentation. Regulation was the initial catalyst for capital and margin reform, but now there is also an economic driver to optimise capital and margin efficiency.

Q: What were the study findings with regards to liquidity?

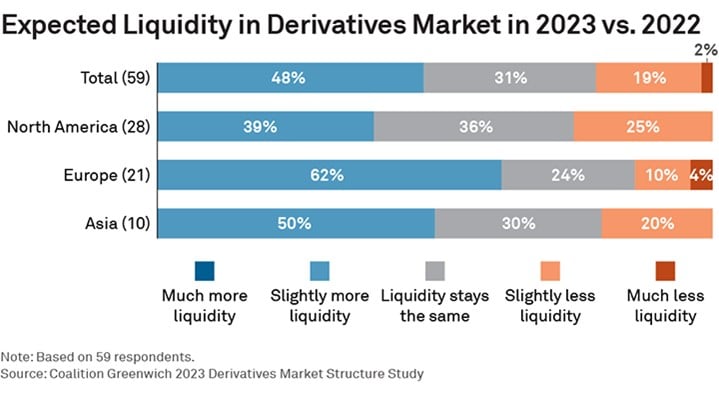

A: For the most part, respondents were generally positive about the potential state of liquidity over the next 12 to 18 months (see the chart below on liquidity expectations by geographic region).

However, despite this bullish outlook, respondents largely felt that capital requirements will decrease liquidity. Why the paradox? It could signal a shift in how firms think about what instruments to trade. For example, a single-name credit-default swap has a vastly different liquidity profile than most futures. If capital requirements on uncleared derivatives become onerous and liquidity decreases in those instruments because of capital requirements, firms may shift to futures, where there has historically been much more liquidity.

Some 86% of respondents said that margin and capital requirements would be a factor in portfolio manager decision-making, showing that these rules will impact what instruments people are going to trade and who they are going to trade with.

“Some 86% of respondents said that margin and capital requirements would be a factor in portfolio manager decision-making, showing that these rules will impact what instruments people are going to trade and who they are going to trade with.”

Q: What role does technology investment play in addressing the capital and optimisation challenge?

A: There are a couple of areas firms need to focus on from a technology perspective. One is very targeted to margin, collateral and capital requirements. For example, people tend to select their collateral in a very rudimentary way. Collateral optimisation partly means using a better collateral selection algorithm. But to better select collateral, firms also need more data points. They need to think about where they are sourcing data, and whether they can consume them into their collateral selection engine in a timely manner. If that is all done post-trade, that is still better than simply pledging cash all the time.

The second area of focus is that firms also need to think about how the entire workflow sits together. How do delays in settlements and the confirm/affirm process, or mistakes on the reconciliations front, affect the firm’s ability to understand their positions and eligible collateral and clean up issues in a timely manner?

“A lot of the efforts we see today are focused on taking post-trade data and working it back into pre-trade execution strategy.”

A lot of the efforts we see today are focused on taking post-trade data and working it back into pre-trade execution strategy. Who will the firm trade with, where, and what will it mean? It is difficult to answer those questions without the right post-trade data feeding into those systems in a timely manner. Firms are looking at the flow of data and decisions from pre-trade to trade to post-trade and then looping back in, so they truly understand the capital and collateral implications of a trade before it is made. That is much easier to do if they are automated on the back end.

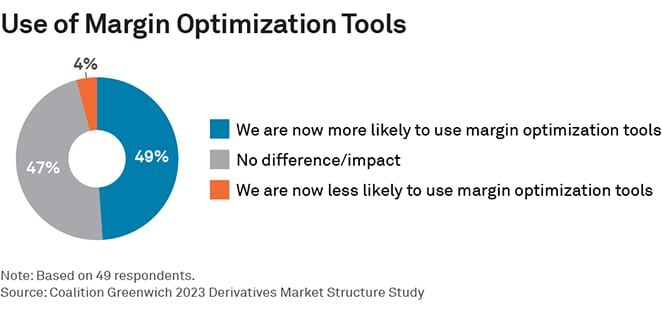

Almost half of the study respondents said they are now more likely to use margin optimisation tools (see chart below).

Q: Which areas of the trade life cycle are the biggest focus for automation?

A: Firms really need to optimise the entire workflow. There are going to be tactical needs to improve certain processes—perhaps a firm’s trade reporting still requires some manual intervention, for example. However, the real benefit will come when the entire workflow is managed so that each part of the workflow is optimised based on the preceding steps.

Q: What is the key takeaway for OTC market participants from the study?

A: Firms should make sure their operating environment is optimised to manage the increasing economic pressure on the derivatives trading franchise coming from margin and capital requirements, future regulations and operational risk.