The upcoming EMIR Refit deadline is fast approaching. Hugh Daly, head of Capital Markets Data & Regulatory Solutions at Broadridge, explores the most prominent obstacles firms face as they work to comply with the updated rules, and shares the strategies firms can use to address these efficiently. Read on to also gather insights from industry peers as reported in the recent EMIR Refit report from Broadridge and Acuiti.

The European Securities and Markets Authority’s (ESMA) version of the European Market Infrastructure Regulation (EMIR) Refit is expected to go live in the first half of 2024, with the UK’s Financial Conduct Authority (FCA) version following shortly after. Financial services firms need to see the FCA and ESMA versions of the EMIR Refit as entirely different regulations.

Regulatory divergence

The FCA is adopting most of the ESMA regulation, so there will not be many changes in terms of the validation rules, but because the go-live dates are different, there will be some complexity for firms that have dual obligations where they are reporting to both ESMA and the FCA. The small time-lag will mean that firms will simultaneously have to report all the additional fields, validations, actions, and event type sequences and the new schema related to the ESMA version, while the FCA still uses the legacy schema and rules. It will be complex to manage this for the three months or so when the two regimes are bifurcated.

In addition, the FCA is releasing a different version of the XML schema to ESMA, and there is a chance that those will diverge more over time. Different schemas and interpretations of rules over time could lead to a slightly wider divergence. As such it is critical that firms see these as completely different regulations.

The global picture adds further complexity

Globally, there will be even more regulatory divergence. For example, the US’ Commodity Futures Trading Commission (CFTC) trade reporting rules rewrite will go live in December 2022. There are concerns over differences with Unique Transaction Identifiers (UTIs). The CFTC is quite prescriptive in terms of UTI formats, whereas other regulators are less so. Where there are open trades reported across multiple jurisdictions, from December, firms will in theory have to start using a “CFTC UTI” which is different to what they use in other jurisdictions. Also, determining who the UTI generator is for multi-jurisdictional trades could prove challenging for firms, with nuances in generation rules across regulations.

The second phase of the CFTC rewrite comes in December 2023 and will include ISO 20022 and Unique Product Identifiers (UPIs) which will require integration with the Association of National Numbering Agencies Derivatives Service Bureau (ANNA-DSB). The introduction of UPI will impact swap regulations globally as they get incorporated by their respective rewrites.

In the Asia-Pacific markets, the Australian Securities and Investments Commission (ASIC), the Hong Kong Monetary Authority (HKMA), the Monetary Authority of Singapore (MAS) and the Japanese Financial Services Agency (JFSA) also have rewrites between now and 2024.

It is like a perfect storm of regulatory change all coming together from now until mid-2024. It is going to be very hectic as firms try to cope with the confluence of rewrites from all regulators, and the different interpretations and challenges that this brings. Regulatory divergence is very difficult to manage without a coordinated strategy.

Data challenges arising from the EMIR Refit

For the EMIR Refit, the number of reportable fields will see a significant increase from 129 to 203. Firms are doing their gap analysis now to figure out where to get the additional data points from. UTI structures diverging presents further data challenges for cross-jurisdictional trades within the context of EMIR Refit.

Another significant area of focus is the updating of pre-go-live trades. Those which are still open at go-live will need to have all the additional data elements, and firms will have to change the format to the new ISO 20022 standard. There will be just six months to implement these changes. Some firms may have trades that have been open for a while where they were not collating the type of data required to fit the new rules, because clearly they did not know at the time that they would need them.

Reconciliations will be under pressure too. EMIR is a dual reporting obligation, so firms need to know what their counterparty is doing as well. For instance, if a counterparty is not fulfilling its compliance obligations, and not populating the right fields, then the other firm or counterparty to the trade will have a reconciliation problem. Any reconciliation breaks are supposed to be rectified within seven days, which in this industry is a massive challenge, where some firms may currently have breaks that sit on their books for months.

From two years following the go live date of EMIR Refit, a later phase of EMIR also looks at reconciling valuations. Firms today do their mark-to-market valuations at different times of the day, and they might use slightly different prices from their counterparties, but will eventually have to reconcile these. Although that is still a couple of years away, firms do need to start thinking about these issues now.

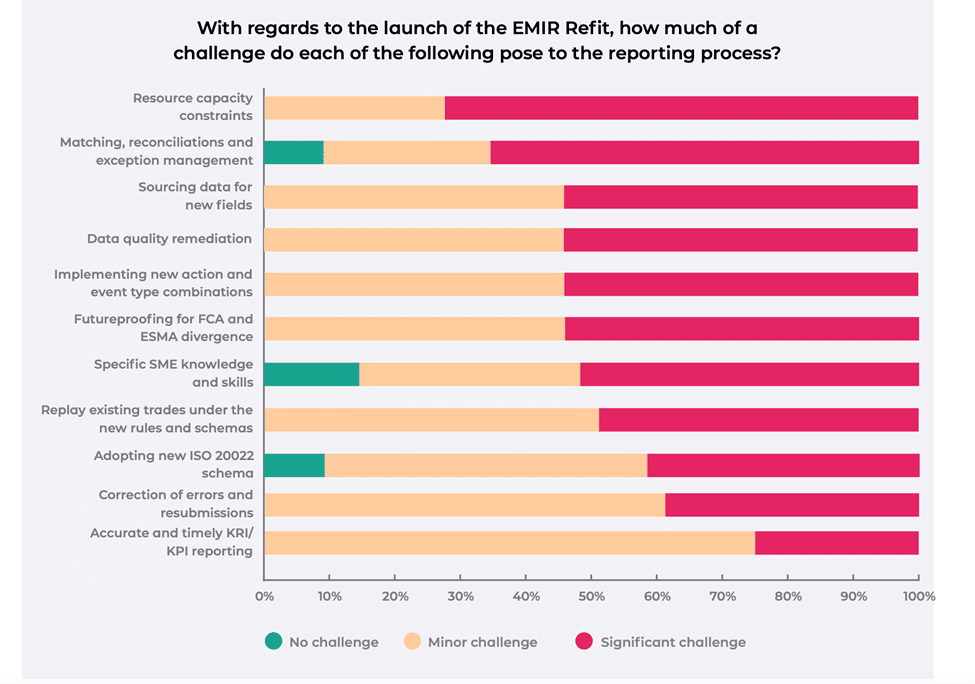

All of these challenges are concerning to market participants as revealed in our recent

report with research firm, Acuiti (see visual below). The report showed data sourcing, data quality, regulatory divergence and reconciliations to be among firms’ top concerns surrounding EMIR Refit.

Source: Acuiti/Broadridge EMIR Refit Report

Given the scale of operational challenges, firms need to start preparing for all these changes now – and be ready for future changes too. For instance, there will be 85 new matching fields at go-live and an additional 66 or so that come in further down the line.

Aside from preparing internally, financial services firms need to begin outreach to counterparties to get a good understanding of how they handle valuations. The more aligned firms are with their counterparties, the less challenging this will be. Two years for this particular requirement may feel like a long time, but it goes incredibly quickly.

A consolidated approach

Many firms historically took a very siloed approach to trade and transaction reporting, involving a lot of in-house solutions created for specific regulations, such as Dodd-Frank. When new regulations came, they bolted on a new solution.

In contrast, a purpose-built third-party solution is scalable by design and enables firms to look at all the different regulations within the same system. Some fields such as Critical Data Elements (CDE) are applicable across all the different regulations, so it can be built for once and applied across all the regulations.

In a siloed approach, a firm might build for the same field multiple times for different jurisdictions, which escalates costs and denies firms the benefits of data aggregation and harmonisation that the regulators are trying to put in place. A siloed approach would cost vastly more than a consolidated one because the firm is maintaining many more systems and paying to integrate more regulations.

Some of the larger banks are looking to build this sort of cross-regulation platform in house. However, it is difficult to make a wholesale change all at once. These firms could, for example, make any changes necessary with the EMIR Refit first and then incrementally add other regulatory jurisdictions over time. Additionally, they would look to strategically consolidate the processing of reporting to all the major swap and securities finance jurisdictions over a multi-year period.

However, it might make more sense to leave this build to third-party regulatory reporting specialists as constant maintenance is required to accommodate the future regulatory changes and new regulations we know will come. By outsourcing this obligation to a third-party, banks benefit from the mutualisation effect and can better focus on their core business activities.

Next steps

With the imminent challenges that the EMIR Refit will pose, firms should focus on the gap analysis to know where they will source the data points for each specific field. They should also look at future changes beyond the initial deadline, such as the additional reconciliations for valuations. And as stated previously, firms should engage with counterparty outreach right away to make sure they know the approach and state of readiness of their counterparties. All the while, firms should be considering how best to leverage their EMIR Refit builds to be congruent with their wider regulatory reporting obligations.

Above all else, the most important thing is not to wait— EMIR Refit can be the catalyst for firms looking to build a more robust, data-rich coordinated approach to compliance and one that supports both current and future needs.