Increasing market volatility and the next phase of UMR are driving more IRS volumes into clearing in Europe. In this DerivSource feature, Max Verheijen, director, Financial Markets at Cardano and Tom Prickett, managing director at JP Morgan Chase describe their experiences with market liquidity and margin funding for their interest rate derivatives activities during recent times of volatility. These market participants, as well as Matthias Graulich, chief strategy officer, and Phil Simons, global head of Fixed Income Sales – Derivatives, Funding & Financing at Eurex, shed light on how additional services, such as cross margining, can help derivatives market participants successfully weather future periods of market stress and achieve greater operational, margin and funding efficiencies.

Interest rate derivatives liquidity amid market volatility

In the early days of the Covid-19 pandemic, market volatility meant that margin activity for both calling and posting collateral increased for many market participants. For some firms, sourcing eligible collateral was a challenge as was finding liquidity in the bilateral market.

Apart from the very apparent market volatility, the onset of Covid-19 also brought logistical challenges, as people were temporarily without a fully functional work set up. While things soon settled and remote working became more normalised, it was sometimes difficult to provide liquidity with the speed everyone was accustomed to, especially as market volatility also worsened liquidity in the dealer-to-dealer market.

Institutions that reacted quickly were best placed to minimise the impact of those challenges, especially those that were able to leverage their disaster recovery sites. Banks have improved their ability to deal with logistical hurdles through the pandemic and technology teams have created greater resiliency. But markets have remained volatile and unpredictable.

Fortunately, there were not any major defaults during this period, but the industry has seen a major shift towards central clearing in the subsequent two years to minimise counterparty and liquidity risks, and as smaller Phase 6 firms come into scope for Uncleared Margin Rules (UMR).

Meanwhile, the European Securities and Markets Authority (ESMA) recently extended the temporary equivalence exemption for clearing for UK clearinghouses for a further three years. However, EU Commissioner McGuinness stated that this will be the last extension and firms will need to migrate their European portfolios to EU-based clearinghouses by June 2025. Most recently the EU Commission has started a public consultation with a focus on measures in order to make the EU environment more attractive and to facilitate the build-out of EU-based liquidity pools.

Buy side clearing strategies respond to liquidity and regulatory pressures

Max Verheijen, director, Financial Markets, Cardano

In March 2020, Cardano’s derivatives trading book was mainly bilateral, and we were only just starting to centrally clear trades. Specifically, our Variation Margin (VM) activities mostly relied on securities, and the high volatility meant the first movement in March 2020 was down. As we are fixed rate receiver in swaps, our collateral desk had to call and demand a lot of collateral. In the end, the banks fared very well and there were no late settlements, however some banks had difficulty during this time sourcing eligible securities as collateral. When rates suddenly rebounded at the end of March/beginning of April, we then had to post the collateral back, which was not problematic because we kept the received collateral separated and did not reuse it. In short, collateral management was not really an issue for us at Cardano during recent times of market volatility.

The bigger challenge at that time was finding liquidity. Trading costs increased, bid offer spreads widened and we had to search for all the liquidity buckets available. Moving to central clearing made a lot of sense to avoid these liquidity obstacles because it opened our access to many more counterparties. In bilateral trading, you must have ISDA agreements in place before you can trade. Most clients typically have no more than seven to 10 bilateral counterparties lined up. Clearing provides a good opportunity to increase the number of available executing brokers and hence source more liquidity in those times of stress.

There were no defaults during the period of volatility in March 2020 and while there were challenges in finding liquidity, there were no issues around margining in those high volatility days. During 2021, we set the path towards central clearing and our clients are adjusting to it. We had to educate many of them around clearing and the role of central counterparties (CCPs) / clearing members as it was a new concept for many. With the final phase of UMR coming into force in September 2022, clients that are above the USD 8 billion threshold are now trying to avoid the Initial Margin (IM) requirements by voluntary clearing. Clients are increasing the number of cleared trades and backloading from bilateral into clearing.

ESMA recently extended the temporary equivalence exemption for clearing for LCH. The extension was expected; however, the three-year period was a surprise. European Commissioner Mairead McGuinness recently emphasised that the June 2025 date is firm and market participants must prepare to clear at EU CCPs. Judging by these comments, a permanent equivalence decision seems less likely. In that respect, we are looking out for suggestions by the market to enhance attractiveness to clear in the EU as requested in the latest European Commission consultation. Liquidity is increasing in the EU, which is good. We would like to be able to clear inflation-linked swaps in Europe as well, because we do not want to leave instruments in the bilateral world if that means we must exchange IM.

“Given the political uncertainty, the safe and default option is to clear as much as possible on Eurex. We advise our clients to clear any new trades at Eurex unless there are reasons not to do so.”

Max Verheijen, Cardano

Given the political uncertainty, the safe and default option is to clear as much as possible on Eurex. We advise our clients to clear any new trades at Eurex unless there are reasons not to do so. These reasons may include specific client interests in LCH or prevailing market conditions for short-dated tactical trades that would favour LCH but would likely be unwound before 2025. Not surprisingly, we already have active accounts at Eurex for all EU clients. We advise clients to take their time moving existing positions because they cannot move all their swap book from LCH in one go. They must trade the basis between LCH and Eurex and they need liquidity for that.

At Cardano, we want to trade positions that will not be held to maturity centrally cleared. We have some products that cannot be cleared, like equity options on baskets of indices because of their exotic nature. For these non-clearable instruments, where possible, we want to circumvent the posting of IM on bilateral trades because that will increase transaction costs.

Liquidity and funding costs drive participants’ clearing strategies

Tom Prickett, managing director, JP Morgan Chase

Sell-side institutions that rely heavily on the dealer-to-dealer market have been greatly impacted by the liquidity issues in that space in recent times. Futures volumes, for example, were very low by historical standards through last autumn. Banks that rely on the dealer-to-dealer market to recycle their risk have found it difficult to provide the same level of liquidity to clients, while the larger multinational institutions that have a bigger franchise and offsetting flow were able to manage that better. Smaller firms that did not have the same advantages of scale were more aggressively exiting risk in the dealer-to-dealer market, which worsened liquidity further and led to more volatile price action.

With a disciplined risk-reward strategy, even views that are ultimately correct can get stopped out by the turbulence in choppy markets. Many speculative positions had to be exited because of that volatility. But because the markets were less liquid, buy-side firms could not simply push risks to the market. Sizeable positions were liquidated in the client-to-client market via dealers, where dealers were able to find offsetting interest at the time of trade and place them directly. This was often the only viable option to exit some of those positions.

Firms that were completely reliant on a non-EU clearinghouse may have experienced heightened concern while the equivalence extension was being debated, but ultimately the extension has been confirmed now, and those firms have been able to retain those positions without any forced migrations. It makes sense for firms to have the ability to book in a range of clearinghouses as it encourages competition and mitigates regulatory risk. I expect that those firms that decided to diversify their ability to book across several CCPs feel in a more robust position from a regulatory risk standpoint than those that are heavily dependent on a single clearinghouse.

“Streaming prices in both clearinghouses (LCH and Eurex Clearing) have been comparable for EURO Swaps through the recent period of market volatility.“

Tom Prickett, JP Morgan Chase

Streaming prices in both clearinghouses (LCH and Eurex Clearing) have been comparable for EURO swaps through the recent period of market volatility. On the other hand, where liquidity might not be comparable, for example, is where a clearinghouse only recently began to support a product. In this case, liquidity can be challenging, and that is likely the single biggest factor in persuading people to look elsewhere or to choose not to move from a more liquid incumbent clearinghouse to a new entrant into the market. Market participants look to see if there are streaming two-way prices in outright products and basis at levels commensurate with other clearinghouses. Other market participants might look at daily turnover.

The cost of posting IM is a key economic consideration in a firm’s choice of clearinghouse or choice of distribution of risk in CCPs. Sometimes the amount of IM that members of a clearinghouse must post is not a linear relationship with the amount of risk they hold. For higher risk positions, there can be a benefit in holding some of that position in another clearinghouse to avoid the nonlinear increase in IM they would have to post if they were only in one CCP. Participants who are set up to trade in more than one clearinghouse can optimise across the CCPs for the positions they hold with respect to the amount of IM they have to post.

Compression is also extremely important. Gross notional often feeds into a requirement to hold extra capital, particularly with banks. There is always an incentive to collapse notional through compression services and it is vital that any clearinghouse that wants to be attractive to business can provide for comprehensive compression services.

When it comes to selecting a clearinghouse, most participants would appreciate more choice as well as more flexibility to choose, rather than being instructed to use a particular clearinghouse. They would prefer to see a healthy marketplace of CCPs offering competitive rates, and flexibility in diversifying across them to mitigate credit risk and IM costs, and to hopefully avoid too much concentration risk.

Liquidity shifting to the EU

Matthias Graulich, chief strategy officer, and Phil Simons, global head, Fixed Income Sales – Derivatives, Funding & Financing at Eurex

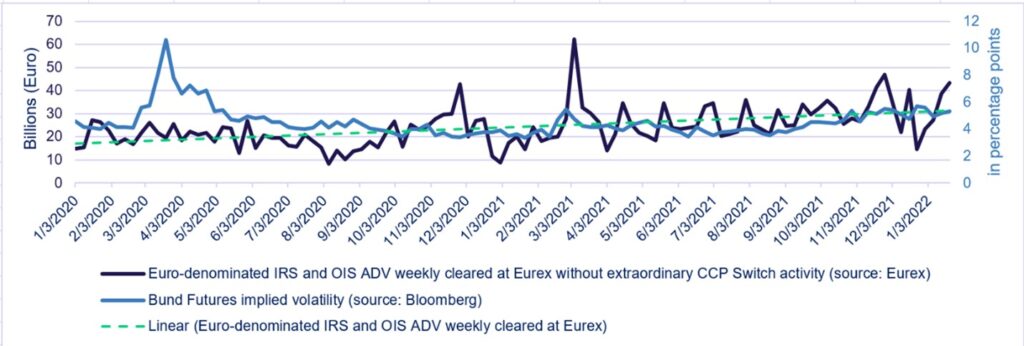

Liquidity is shifting to the EU as illustrated by robust volumes we have seen at Eurex which are unaffected by the increasing market volatility. During recent times, there was a slight widening in bid-offer spreads quoted on electronic streams, but that was noticeable across all markets and CCPs. As a result, the bulk of business was done via voice or Request for Quote (RFQ) and market participants were getting good prices inside the spread. This is a natural reaction to periods of stress and volatility. Essentially, the Eurex market behaved the same way as other CCPs during times of recent market stress.

January 2022 volumes reached nearly EUR 6 trillion in mostly long-dated interest rate swaps (IRS) and Overnight Index Swap (OIS), being driven by EU accounts. The biggest build-up of risk exposures at Eurex is coming from small and medium-sized banks. There is also a significant portion coming from asset and wealth managers as well as pension funds. The hedge funds do not have a big share yet, but momentum is increasing among the hedge funds business. The topic of margin costs will become more interesting with the interest rate changes in Europe coming up on the horizon, which should create more appeal for hedge funds to trade Euro denominated futures against swaps.

Figure 1: Eurex swap volumes / liquidity have been unaffected by increased volatility in fixed income markets

Eurex has made refinements to its cross-margining algorithm making it more efficient and increasing the level of offsets that are possible. Several clearing members are offering cross product margining to their clients now and many others are about to finalise their implementations to do so in the first half of 2022. This is important because until last year, a hedge fund could not take advantage of cross-product margining because there was no global dealer offering that service. Even though Eurex has had cross-margin capabilities for many years, it was down to the capabilities of the clearing member to make it available to the client.

As part of Eurex’s partnership programme, we have embedded incentive mechanisms for the large global dealers to show as part of their liquidity provision tight bid-offer spreads and good prices streaming throughout the day. These liquidity provider incentives worked well during regular times and during times of market stress.

Since the start of 2022, there has been a significant increase in volatility, driven by inflationary pressure and central banks looking to taper their quantitative easing programs. With this increased volatility and the increase in interest rates, coupled with the need for managing the funding requirements associated with VM, more and more clients, especially pension funds, are moving to clearing. ESMA has stated that pension funds will only receive a one-year extension because they now have access to the cleared repo market to cover their funding requirements at the CCP. Having this linkage between repo and Exchange-Traded Derivatives and Over-the Counter derivatives makes Eurex a very efficient and effective home for those clients.

While the EU Commission has extended the temporary equivalence for non-EU CCPs until 2025, there is a clear desire to make the EU clearing environment more attractive facilitating the process to build out exposures within the EU. The objective in building bigger exposures within the EU can be achieved continuing the market-driven approach Eurex has started with its partners about 4 years ago. Some incentives from a regulatory and central bank side would of course positively stimulate these developments.